Le Problème

Les collectivités et PME font face à une triple menace : cyberattaques, complexité logistique et surcharge informationnelle. Les outils pour y répondre sont souvent silotés, trop coûteux ou réservés aux grands groupes.

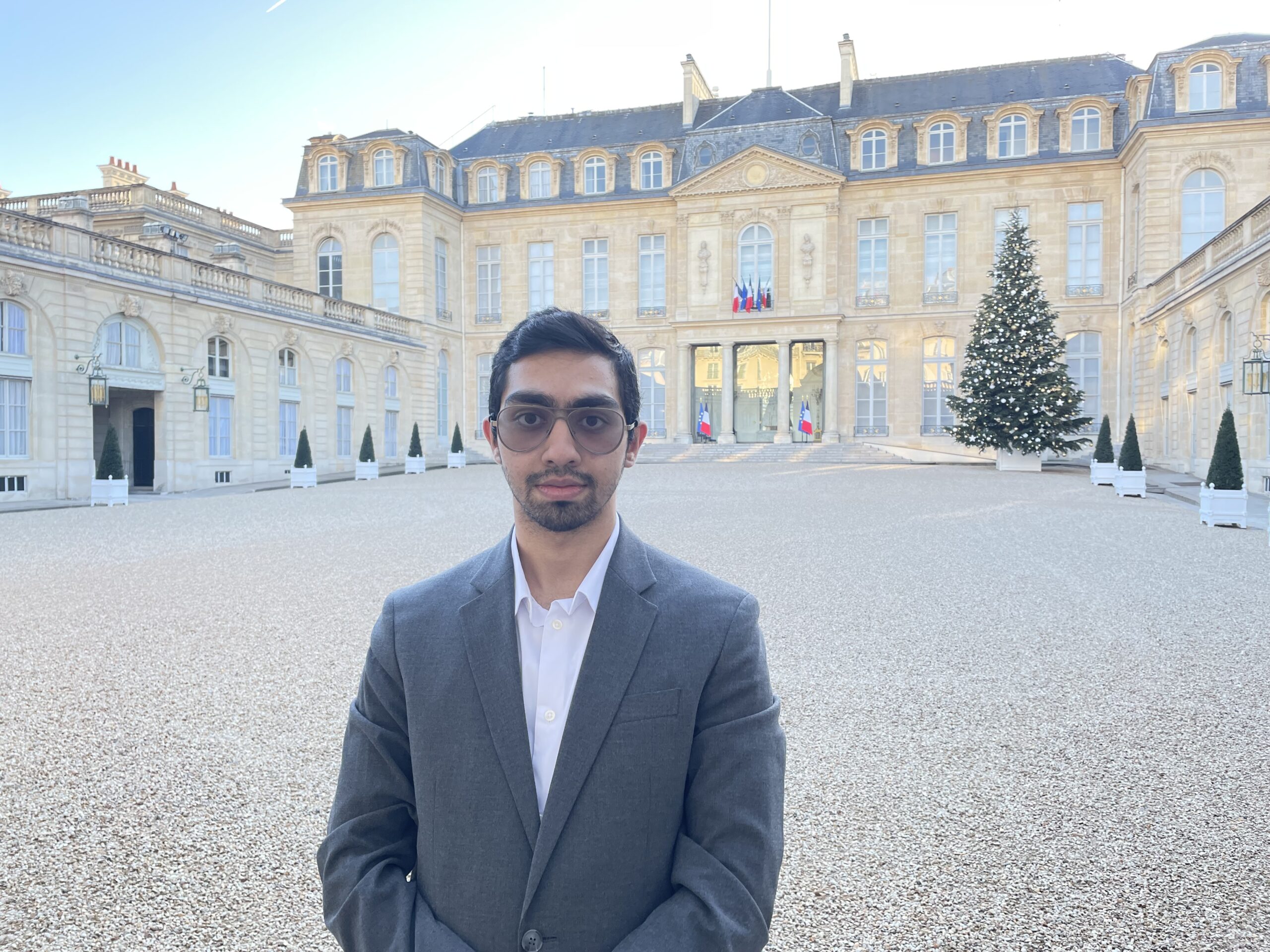

Fondateur de VoilaVoila.fr

Mon parcours s'est construit à la confluence de plusieurs univers d'excellence : l'engagement pour l'intérêt général, au sein de l'État comme pour des organisations internationales, la maîtrise des systèmes d'information critiques, éprouvée jusqu'aux plus hautes exigences du secteur bancaire du CAC 40, et une passion pour l'innovation stratégique.

J'ai forgé une certitude : la technologie ne révèle son plein potentiel que lorsqu'elle est au service d'une vision — humaine par sa finalité, stratégique par son application.

C'est de cette philosophie qu'est né voilavoila. Pas seulement un outil, mais une capacité nouvelle offerte à ceux qui sont au cœur de notre souveraineté.

Les collectivités et PME font face à une triple menace : cyberattaques, complexité logistique et surcharge informationnelle. Les outils pour y répondre sont souvent silotés, trop coûteux ou réservés aux grands groupes.

voilavoila est une plateforme de pilotage stratégique qui combine un bouclier de cybersécurité, un moteur d'optimisation logistique (IA), et un radar de veille stratégique (OSINT) en un centre de commandement unifié.

Rendre la souveraineté technologique accessible à tous. voilavoila n'est pas un outil, mais une capacité de résilience, différenciée par une technologie souveraine et un partenariat humain fort.

Au-delà de la technologie, l'IA souveraine est une question de maîtrise de notre destin numérique. Pourquoi le déploiement local de l'IA est crucial...

Bientôt disponibleLes leçons de la planification militaire peuvent offrir des stratégies robustes et accessibles pour organiser une défense efficace sans budgets colossaux...

Bientôt disponibleCoordonner des centaines de personnes apprend l'anticipation. Comment ces principes peuvent-ils transformer la logistique des collectivités ?...

Bientôt disponible

Pour discuter d'une collaboration, d'un partenariat ou simplement pour échanger sur ces sujets, n'hésitez pas à me contacter.

farhad@voilavoila.fr

VV Chat securisé dispo !